The Power of Savings: Why and How to Save Money

Saving money is a crucial financial habit that provides security, peace of mind, and the ability to achieve future goals. Whether you're saving for emergencies, a dream vacation, or long-term wealth, adopting smart saving strategies can transform your financial health.

Why Should You Save Money?

-

Financial Security – Savings act as a financial cushion during unexpected situations like medical emergencies, job loss, or sudden expenses.

-

Achieving Goals – Whether it's buying a home, purchasing a car, or funding education, savings help in reaching these financial milestones.

-

Retirement Planning – Investing in retirement savings ensures a comfortable life after retirement.

-

Avoiding Debt – Having savings prevents the need to take loans or rely on credit cards during financial crises.

Effective Ways to Save Money

-

Set a Budget – Track income and expenses to allocate a portion of earnings towards savings.

-

Use the 50/30/20 Rule – Spend 50% on needs, 30% on wants, and save 20% of your income.

-

Open a Savings Account – A high-interest savings account helps grow your money over time.

-

Automate Savings – Set up automatic transfers to your savings account to ensure consistency.

-

Cut Unnecessary Expenses – Reduce spending on non-essential items like dining out, subscriptions, and impulse shopping.

-

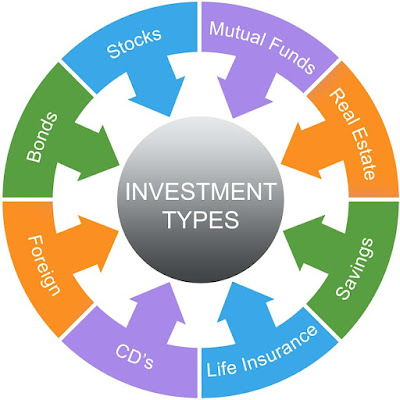

Invest Wisely – Consider investing in mutual funds, fixed deposits, or stocks to grow your wealth.

Best Savings Accounts in India (2025)

Here are some top banks offering high-interest savings accounts:

| Bank Name | Interest Rate (p.a.) |

|---|---|

| SBI | 2.70% – 3.50% |

| HDFC Bank | 3.00% – 3.50% |

| ICICI Bank | 3.00% – 3.50% |

| Bank of Maharashtra | 2.75% – 3.50% |

| Axis Bank | 3.00% – 3.50% |

Final Thoughts

Savings is not just about keeping money aside; it’s about securing your financial future. Start today by setting small goals, being consistent, and making smart financial decisions. Your future self will thank you!

.jpg)

.jpg)